Buying a home can be expensive, and many buyers struggle to cover all the upfront costs involved in a real estate transaction. That’s where a seller credit in real estate can make a big difference. Also known as a seller concession, a seller credit is when the seller agrees to contribute a specific amount toward the buyer’s closing costs. This financial support eases the buyer’s burden without reducing the property’s sale price, making it a powerful tool in the home-buying process.

Seller credits appear most often in buyer’s markets, where sellers offer incentives to help close the deal. Buyers can use these credits for various expenses, such as loan origination fees, title insurance, and escrow charges. However, lender guidelines usually prohibit using seller credits for down payments or debt payoff. The loan type and lender rules often determine the maximum amount allowed. For instance, conventional loans typically cap seller contributions at 3% of the sale price, while FHA loans may allow up to 6%.

Understanding how seller credits work gives both buyers and sellers a valuable edge during negotiations. Buyers lower their upfront costs, and sellers attract more offers without changing the listing price. When used wisely, seller credits help create smoother transactions and more satisfied parties.

In this article, we’ll break down everything you need to know about seller credits in real estate—how they work, their benefits and limits, and how to negotiate them effectively. Whether you’re a first-time buyer or an experienced investor, learning to use seller credits to your advantage can help you make smarter decisions throughout the home-buying process.

How Seller Credits Work

A seller credit in real estate is usually negotiated during the offer phase of a home purchase. Instead of lowering the sale price, the buyer might ask the seller to cover part of their closing costs. For example, if a buyer offers $300,000 and requests $6,000 in seller credits, the seller still nets $294,000. The buyer finances the full $300,000 but gets help covering necessary transaction costs.

The seller doesn’t give the credit directly to the buyer. Instead, the funds are applied to approved closing costs, such as appraisal fees, title insurance, escrow charges, and loan origination fees. Lenders usually don’t allow seller credits to be used for down payments or personal debt. The credit must meet lender guidelines and get approved before closing.

The buyer’s loan type affects how much a seller can contribute. Conventional loans often cap seller credits at 3% of the purchase price when the buyer puts down less than 10%. FHA loans allow up to 6%, and VA loans may let sellers cover all closing costs, within certain limits.

According to the Consumer Financial Protection Bureau (CFPB), loan program rules help determine how much credit is allowed. Because of these limits, buyers and sellers need to work closely with their agents and lenders. This ensures the credit is structured properly.

The purchase agreement must list the credit amount. Lenders review this during underwriting. If the home doesn’t appraise for the full offer price, the buyer may need to renegotiate or pay the difference in cash.

Understanding this process helps both sides avoid surprises. A seller credit in real estate can be a smart financial tool when used with care and good communication.

Benefits of Seller Credits

A seller credit in real estate can be a win-win strategy when used correctly. For buyers, the main advantage is financial relief. Closing costs typically range from 2% to 5% of the home’s purchase price. For a $300,000 home, that could mean an additional $6,000 to $15,000 out-of-pocket at closing. Seller credits help reduce or even eliminate these expenses, allowing buyers to preserve cash for moving expenses, emergency funds, or home improvements.

This is especially helpful for first-time buyers who may be stretching their budgets to cover a down payment. With a seller credit, they can complete the transaction more comfortably. For some, it may even be the difference between qualifying for a loan or being priced out of a home altogether.

For sellers, offering a credit can make their listing more attractive—especially in a competitive or slow-moving market. Rather than lowering the asking price, a seller can provide a closing cost credit to meet buyers where they are financially, while still preserving the home’s value on paper. This tactic may help a home sell faster and reduce the chance of price negotiations stalling the deal.

Seller credits also appeal to buyers using mortgage financing, as they allow buyers to finance the full purchase price, including the credit. This approach can strengthen an offer without the need for immediate cash, improving both the deal’s structure and buyer confidence.

However, both parties must ensure the credit is documented correctly in the contract and stays within loan guidelines. For more advice, check out our post on rent-to-own homes, which also provide flexible buying options.

To explore national housing market trends that may affect your negotiation strategy, visit the National Association of Realtors’ statistics page.

Important Considerations and Limitations

While a seller credit in real estate offers clear advantages, it also comes with limitations. Buyers and sellers must understand the rules that govern these concessions to avoid issues at closing. Seller credits apply only to closing costs. They can’t cover a buyer’s down payment, reserves, or existing debt. So, buyers still need enough liquid funds to meet loan and down payment requirements.

Another critical factor is the home appraisal. The property must appraise at or above the full purchase price, including any seller credits. For example, if a buyer offers $305,000 and requests a $5,000 credit, the home must appraise for at least $305,000. If it falls short, the buyer may need to renegotiate or cover the difference out of pocket. Either scenario can delay the transaction.

Lenders enforce strict rules on seller contributions. Most loan types allow between 3% and 6% of the purchase price. Going beyond those limits could lead to loan denial. That’s why buyers should consult their lender and real estate agent early in the process. It’s the best way to ensure the deal complies with program requirements.

Market conditions also matter. In a seller’s market, where homes sell quickly with multiple offers, requesting a seller credit can weaken your position. Sellers often choose buyers who don’t ask for concessions. Understanding your local market helps you create a strong and realistic offer.

To dive deeper into how appraisals affect transactions, read our post on what appraisers look for in a home. For official FHA limits and seller credit rules, check the U.S. Department of Housing and Urban Development.

How to Negotiate a Seller Credit

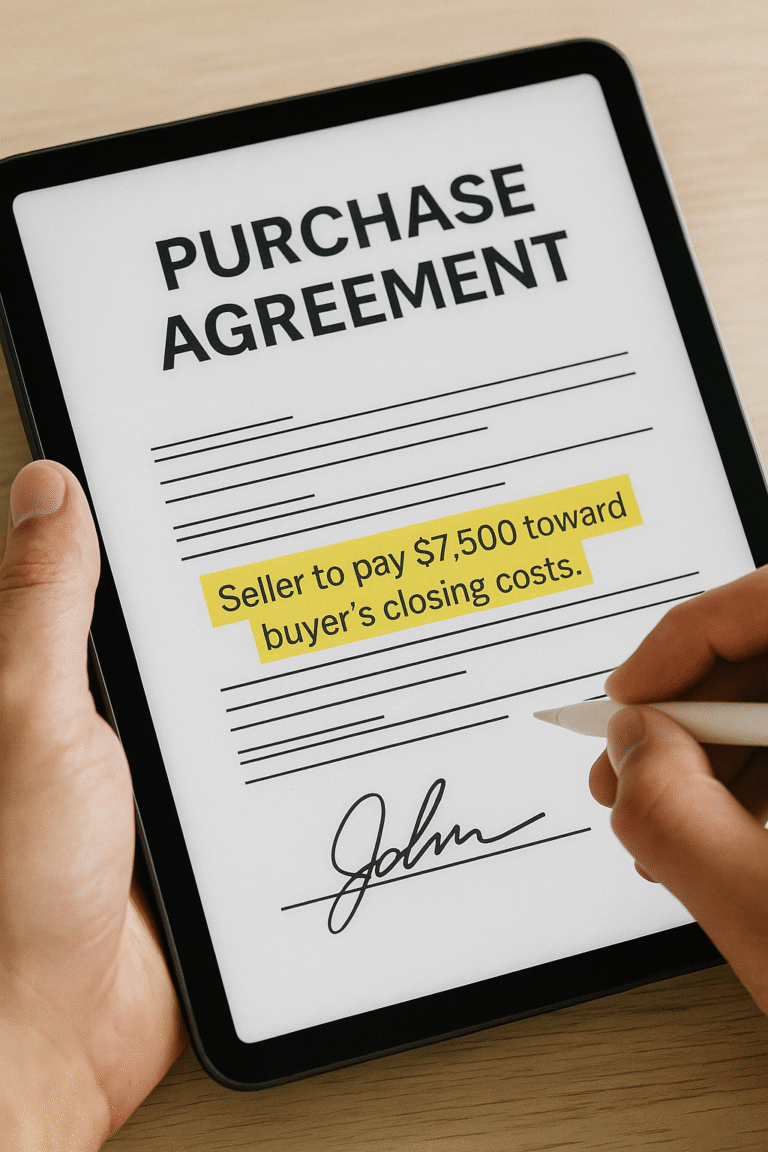

Negotiating a seller credit in real estate requires a strategic approach. Both buyers and sellers must understand how credits impact the transaction and use them to achieve a win-win outcome. For buyers, the key is timing. Credits are most effective when negotiated during the offer stage—not after. Include the requested amount in your initial purchase agreement, clearly outlining how the credit will be used (e.g., “Seller to credit buyer $5,000 toward allowable closing costs”).

Working with an experienced real estate agent is crucial. Your agent can evaluate the local market, assess the seller’s motivation, and advise whether requesting a credit will weaken your offer. In competitive markets, requesting a large credit could cause your offer to be overlooked. In slower markets or with homes that have been listed for a while, a seller credit may be welcomed if it helps close the deal.

Sellers may also offer credits proactively to attract more buyers, especially if the home needs repairs or has been on the market for an extended period. Rather than reducing the sale price, offering a credit for closing costs can help maintain the property’s value while giving buyers financial flexibility.

Communication with your lender is essential. Make sure the credit you negotiate complies with loan limits and is properly documented. The credit amount should be listed in the contract and confirmed during underwriting to avoid closing delays.

For more guidance on real estate deal structuring, visit our guide on flat fee real estate brokers to learn how seller flexibility can save money. You can also refer to Fannie Mae’s official site for detailed seller contribution limits on conventional loans.

Conclusion & Final Thoughts

Understanding how a seller credit in real estate works can be a valuable asset for both buyers and sellers. When applied strategically, seller credits reduce the financial burden on buyers by covering closing costs, while helping sellers maintain a strong listing price and attract qualified offers. These credits can streamline the transaction and make it more affordable—especially for first-time buyers or those with tight budgets.

However, it’s essential to follow the rules and guidelines set by lenders and loan programs. Not every credit is allowed, and exceeding contribution limits can jeopardize the deal. That’s why it’s so important to work closely with your real estate agent and lender to ensure that your credit is compliant, clearly documented, and realistic based on the property’s appraised value.

Buyers should also consider the current market conditions before requesting a seller credit. In a hot market with limited inventory, asking for concessions could put you at a disadvantage. But in a more balanced or buyer-friendly market, a well-negotiated credit could be the tool that helps you close on your dream home.

Ultimately, seller credits can be a powerful part of the negotiation process when used thoughtfully and correctly. Whether you’re buying or selling, being informed about these financial tools can help you make smarter, more strategic real estate decisions.

If you’re exploring other creative ways to buy a home, check out our article on rent-to-own homes, which offer flexible paths to ownership. For more information on real estate financing rules, visit the Freddie Mac website.